yale new haven taxes

Combined with money the university already promised Yale will contribute 135 million in. Yale takes beating in budget hearing as residents want university to pay more taxes - New Haven Register.

New Haven Alders Push 838m Neuroscience Center Forward Amid Traffic Gentrification Concerns

Tax Haven provides free tax preparation services for families earning less than 66000 a year by partnering with an IRS-certified Volunteer Income Tax Assistance VITA site.

. Yale announced Wednesday that it plans to nearly double its current yearly payments to the city of New Haven over the next five years. IN-PERSON New Haven Tax Prep Providers. Federal tax return even if you do not have US.

For Elicker the issue is New Haven is facing a possible 13 million budget shortfall so he is calling on Yale University for help. Tax system is a pay-as-you go system in that there are usually automatic tax withholdings from your paycheck stipend or financial aid. Since all international students and scholars are required to file a US.

The citys tax-exempt properties which include Yale properties and other properties also increased by over 16 percent in value from 85 billion to 98 billion. 2 Visions Pitched For Getting More From Yale - New Haven Independent. Tax YLS Become part of our vibrant community.

A Notify Me Later box will appear. Of the 98 billion valuation of the citys tax-exempt properties during the latest revaluation 42 billion or nearly 43 percent are owned by Yale University. It may take a minute to process the request.

Walker and Greenberg. Design by Meter Hans. Then amid a recession and city budget crisis community groups rallied behind a state bill written by New Haven State Rep.

The bill seeks to clarify how a law passed in 1834 applies today. The new commitments we make today are informed by decades of engagement and service offered by members of. New Haven generates approximately 30 million in annual property taxes for every 1 billion of taxable land meaning the city misses out on about 141 million in tax dollars each year from Yale.

The good news is that you will not need to worry about filing your taxes until the Spring semester mid-April every year and we will share. In 1834 the state of Connecticut amended the Yale charter to exempt the University from local taxes on any property that makes less than 6000 in income each year. Tax YLS New Haven CT.

Yale paid only 49 million in taxes in 2018 but New Haven claims the University should be paying twenty-six times that amount. Tax Haven ensures that our families are receiving the maximum refund they qualify for completely free of charge. Click My Tax Documents.

An increase in Yales voluntary payments to the City totaling 52 million in new money over six years. Tuesdays press conference echoed a political moment that happened in New Haven in 1990 with a new twist. Yale further said it contributed 15 million to the Yale Homebuyer Program which offers Yale employees 30000 to purchase homes in certain parts of New Haven.

Yales current payments to the. New Haven CT 06511. NHFPL offers free annual tax preparation assistance through partnership with Yales Volunteer Income Tax Assistance VITA.

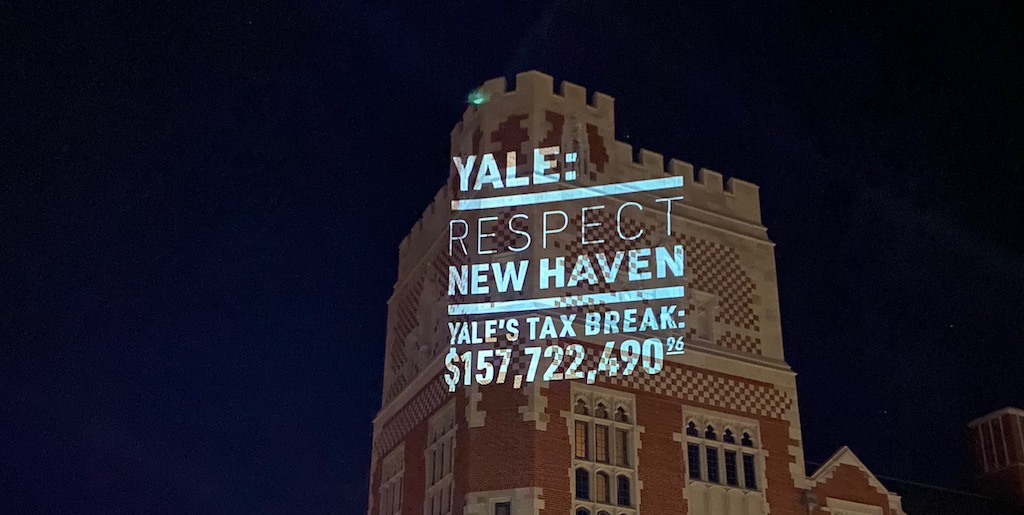

This year Yale University and Yale New Haven Hospital are receiving a combined tax break over 157 million for its New Haven tax-exempt real estate even after accounting for their voluntary payments and the State College and Hospital PILOT payment that New Haven receives. All international students and scholars have a federal tax filing requirement even if you do not have US. 2016 Form 990 Filing.

A favorable determination letter is issued by the IRS when an organization meets the requirements for tax-exempt status under the Code section the organization applied. Tax system and begin to understand your obligations. Ut enim ad minim veniam quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat.

That 1834 law granted a special tax exemption to Yale and four other then-small Connecticut college and universities over and above the. Income Tax System Basics. Since 1994 it said more than.

The tax calculator here shows how much less each property owner could pay in taxes while generating. New Havens taxable and non-taxable grand lists tipped further out of balance last year as the tax-exempt list increased by nearly 195 million to a record high number of 847 billion in value. Yale should do more - New Haven Register.

Yale new haven hospital EIN. Source income you should start familiarizing yourself with the US. Yale loves New Haven said President Salovey.

Community Action Agency of New Haven. Our tax preparation site will be operating online and in person this year. To print your W-2 Use the Print Icon at the Far Right of your screen.

The value of Yales tax-exempt property has. A new tab will open and display your W-2. The 320-year-old institution recently announced a.

About Us Lorem ipsum dolor sit amet consectetur adipiscing elit sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. If this box is clicked you will need follow the steps below under Access Your W-2 in PDF Format. The unions and New Haven Rising said in a press release that the two institutions are getting a tax break of 157722490 up from 146079896 last.

New Haven CT 06511. Yales contributions from these programs are expected to total more than 100 million during the six-year period in addition to Yales new 140 million investment over that time. Yale New Haven Health last week announced plans to acquire Manchester.

Private nonprofit institutions like Yale are in many ways tax-exempt and their host cities receive little revenue from the institutions compared with typical for-profit businesses. With the support of local business leaders Yale President Peter Salovey called an unprecedented press conference to oppose the proposed law State Senate Bill 414. Pat Dillon that targeted the same 1834 statute which provides extra tax exemptions to Yale and five.

Yale should increase its voluntary contribution by 25 million - New Haven Register. Yale University will voluntarily pay 135 million to the city of New Haven Conn over the next six years per an agreement the university announced Wednesday. Below are a few things you need to know.

Now nearly 60 percent of the Elm Citys property holds a. By completing a number of training modules and exams I became a. Three Connecticut hospitals now set to be acquired by the Yale New Haven Health system contribute millions in municipal taxes to their host cities and towns an arrangement likely to change if the facilities shift to nonprofit status under Yale New Havens ownership.

The Shadow Tax Yale Daily News

Should All University Property Be Tax Exempt The James G Martin Center For Academic Renewal

It S Time For Yale University To Pay New Haven By Gabriela Margarita De Jesus Medium

New Haven Financially Speaking A Slowly Sinking Ship

The Shadow Tax Yale Daily News

Yale S Community Investments Support New Haven Business And Tax Base Growth Yalenews

Why A Yale Pediatrician Is Helping Families File Their Taxes Yale School Of Medicine

Yale S Tax Exempt Property Value Surges By Nearly 700 Million Yale Daily News

The Ivory Tower Is Dead Dissent Magazine

Exploring Yale New Haven Office Of International Students Scholars

After Years Of Advocacy Yale University Agrees To Historic Deal With City Of New Haven The Business Journals

New Haven Mayor Yale State Must Help With Looming 66m Budget Deficit

Faqs On State Legislation To Tax Yale S Academic Property Yalenews

Yale Posts 203m Surplus City Projects 13m New Haven Independent

Yale University S Looming Big Deal With New Haven Highlights Growing Outcry For Greater Accountability The Business Journals

Yale Announces Historic 135 Million Payment To New Haven Connecticut Public

Opinion Yale Respect New Haven And Our Unions

Yale Announces Historic 135 Million Payment To New Haven Connecticut Public

Cost Of Living In New Haven Ct Taxes Housing More Upgraded Home